So we won the War on Poverty by killing the incentive to work? Have I got this about right. I didn't think so. It sounds like this guy went a down a long road of confusion to basically say, we need a new measuring stick. That will just change the reporting of the issue in the future, not any of the underlying conditions.

But this is the kind of crap that passes for expert commentary these days.

from Forbes.com:

US Poverty Rate is Still 14.5%; But Yes, The War On Poverty Worked:

I know, I know, it seems very odd: the rate’s the same, we’ve spent tens of trillions of dollars on this (using the current value of money) and yet I say that it has worked. What’s going on here?

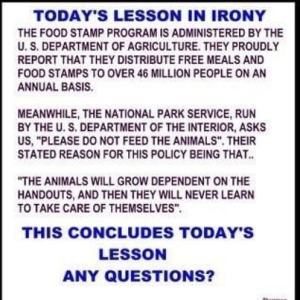

The detail is simply in the way that the US measures poverty. We’ve a number for the income of a family of a certain size. If they get less than that then we define them as poor. All of which seems simple enough. That number goes up as inflation goes up but that’s it, we don’t, unlike other countries, change it for wages going up, for the country in general getting richer. So, at first look, that poverty rate should be coming right down. We spend near $1 trillion a year on sending things and money to the poor and that really should push some large number of those poor families over our line. But it seems that it doesn’t: so, why?

Because, would you believe it, we don’t actually count most of the money that we give to the poor as being incomes to the poor. Weird but entirely true. We have roughly, in order of size, four large programs to alleviate poverty. Medicaid, the EITC, SNAP (food stamps) and Section 8 housing vouchers. There’s a vast raft of smaller programs following on as well. And almost all of them give things (health care, food stamps, rental apartments) to people instead of cash. The EITC is paid through the tax system. And the way we measure poverty is simply that goods and benefits in kind, plus aid through the tax system, are not counted as income when we measure the poverty line.

We could give everyone twice what they get now, five times what they get now, and the number living in poverty woudn’t change by one single person or family.

That might not be the most sensible way to be measuring it but it is the way that it is done. The US alleviates vast amounts of poverty. When we measure all those goods and things the child poverty rate is 1 or 2%. Which is pretty good for government work and very different indeed from the 19% or so that the current method of measurement gives us.

There is one more important point here too. Back when Johnson was gearing this thing up aid to poor people was in direct cash transfers. Those are measured as income to poor families before we measure the poverty line. So back then the poverty line was a measure of people who were poor after the government had helped them. Today we measure before almost all of the help that people get (there’s still a couple of small programs that dole out cash). So today’s measurement is more like the number of people who would be in poverty if government weren’t going to help them.'via Blog this'

For a better perspective of the situation as it is, from someone who apparently works within said system.

Read: Welfare's Failure and the Solution:

http://www.aei.org/files/2012/07/11/-alexander-presentation_10063532278.pdf

by Gary D. Alexander, Secretary of Public Welfare, Commonwealth of Pennsylvania

It's a real eye-opener.

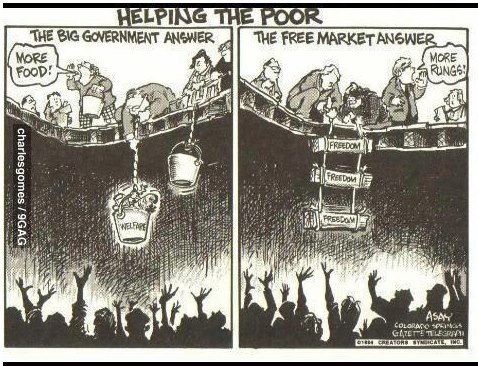

And nothing about the introduction of perverse incentives or the impediments to building a growing economy that would take people off welfare ie: Too Many People on the Cart, Not Enough People Pulling the Cart.

Great googly moogly.

With OSHA and other various federal agencies that have sprung up over the last generation to protect workers, how is #6 even possible. Except state have (perverse) incentives ($$$) to funnel people toward disability (which the Fed pays for) rather than Welfare (which the State pays for).

Don't even get me started on the effects of ObamaCare:

Great system we have going here at any rate. End the War on Poverty. PLEASE!!! Before it kills us all, especially those left pulling the cart.Consider, for instance, how the subsidies for Obamacare are affecting economic growth:The CBO, the government's nonpartisan number-cruncher, included the figures in its projection of economic growth over the next decade. The CBO estimates that Obamacare will lower full-time employment by 2.3m in 2021, compared with what might have been without reform. That 2.3m drop is nearly three times larger than the CBO's earlier projection.The CBO does not give credence to Republicans' common claim that Obamacare is already reducing employment. Rather, the CBO expects Obamacare to have its biggest impact from 2017. Furthermore, the main reason for the decline is not that employers will slash jobs, but that Americans will choose to work less. Nevertheless, the CBO provides the best case yet that Obamacare will depress work, rather than boost it.Many factors account for the drop. Top among them is the affect of subsidies for health insurance. To help Americans buy coverage on new health "exchanges", Obamacare offers tax credits to those earning between 100% and 400% of the federal poverty line (about $11,500 to $46,000 for a single adult). Those tax credits are offered on a sliding scale, by income, so workers effectively pay a higher tax rate as their wages rise. This may dissuade workers from trying to earn more. It also allows a higher standard of living (that is, with health coverage) at a lower income, which may further discourage work.[. . .]The CBO analyses other provisions, too. For example the higher payroll tax for couples earning $250,000 or more may lower their desire to earn higher wages. Obamacare's requirement that insurers cover the sick, without raising their rates, may prompt some to retire earlier than they would have otherwise.The unintended affect of Obamacare is that it provides incentives to work less — or to not work at all. And with fewer people in the workforce, the government will be bringing in zero revenue from the income those people would have otherwise generated.This outcome was not exactly unexpected — it was what Republicans had predicted all along — but it seems to come as a surprise to President Obama. Perhaps he should invite Laffer to bring his napkin to the White House to show him exactly where he went wrong.

from Carpe Diem:

http://www.aei-ideas.org/2012/07/6-charts-that-show-the-welfare-state-run-amok/

1. Fewer workers and their tax payments have to support more and more Medicaid recipients.

2. The number of takers is now approaching the number of makers.

6. Disability enrollees have exploded and are rising faster than job creation.

Even the Brits, socialists that they are, have begun to at least ask the relevant question. How much giving is too much?

They like us, haven't got the heart -- or maybe it's the head -- to figure out the right answers. So here they are.

No comments:

Post a Comment