A noble gesture and goal -- to improve communications with the masses -- but my guess is, after participating in the exchange, that he will never do this again and that the prevailing sentiment among the Tweet-inati is that he spend less time tweeting and more time fixing the economy.

from the Washingtonpost.com

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/01/14/got-questions-for-ben-bernanke-take-them-to-twitter-this-afternoon/

In the past few years, Ben Bernanke has brought Federal Reserve communication into the 20th Century, with television interviews and regular news conferences. This afternoon, he’ll try bringing it into the 21st.Bernanke will take questions through Twitter for the first time, as the Fed chairman participates in what is intended to be a free-wheeling, open-ended discussion Monday afternoon at the University of Michigan’s Ford School of Public Policy.

I have to admit though, reading some of the Twitter questions that came through from all over the country and the sampling from the folks at Zero Hedge (where again, I do recommend reading the comments section) were simply hilarious. I haven't laughed that hard in years.

Maybe the best lesson learned from all of this is that at the very least, considering all that we've been through and are likely to continue to go through in the coming years, America has not lost her sense of humor. For that we are grateful and hopeful.

LANGUAGE ALERT: Some of the comments are a bit salty (especially the ZH crowd). If you are under 18 or easily offended, please get an adult to supervise you NOW - BEFORE PROCEEDING!!

If you can tolerate the sauciness however and you follow economics even slightly, you should be ROTFLYAO.

So, without further ado or pomp and circumstance, I give you the battle between Ben Bernanke and the Illuminati versus The Voices of America and the Twitter-inati.

These are some of the questions that I felt needed answering from the Fed. None were addressed directly, but the Platinum coin idea was summarily dismissed.

from The Slav's Twitter:

Bernanke taking questions today.....theslav1959 When are you going to admit that your cabal are thieves and turn yourselves in to the proper authorities to face trial? #fordschoolbernanke -1:05 PM Jan 14th, 2013 - Think he'll address mine?

FYI: MB refers to the infamous interview with CNBC legendary "money-honey" Maria Bartiromo. For those of you who missed it, here it is fresh from the archives.

From CNBC.com

7/1/05 – Interview on CNBC

INTERVIEWER: Tell me, what is the worst-case scenario? We have so many economists coming on our air saying 'Oh, this is a bubble, and it's going to burst, and this is going to be a real issue for the economy.' Some say it could even cause a recession at some point. What is the worst-case scenario if in fact we were to see prices come down substantially across the country?

BERNANKE: Well, I guess I don't buy your premise. It's a pretty unlikely possibility. We've never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don't think it's gonna drive the economy too far from its full employment path, though.

INTERVIEWER: Tell me, what is the worst-case scenario? We have so many economists coming on our air saying 'Oh, this is a bubble, and it's going to burst, and this is going to be a real issue for the economy.' Some say it could even cause a recession at some point. What is the worst-case scenario if in fact we were to see prices come down substantially across the country?

BERNANKE: Well, I guess I don't buy your premise. It's a pretty unlikely possibility. We've never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don't think it's gonna drive the economy too far from its full employment path, though.

------

More on Ben "I'm Forever Blowing Bubbles" Bernanke from mybudget360.com:

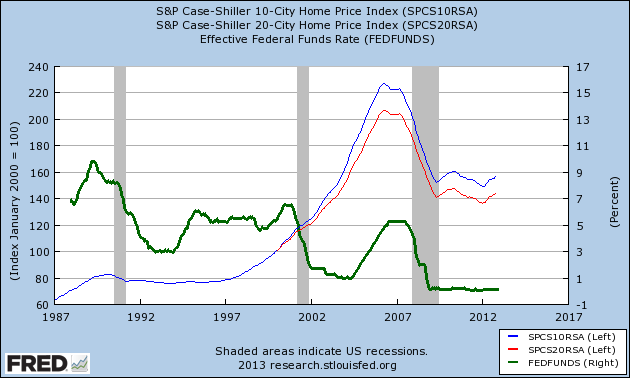

http://www.mybudget360.com/federal-reserve-bubble-escape-clause/One of big reasons for the housing bubble was because of the Fed's inaction in the banking industry. The Fed has the power to patrol and monitor banks. Instead, in the early 2000s when it was clear housing values were taking off for no reason aside from a mania, the Fed drove interest rates into the ground:

The Fed essentially added fuel to the flame. By the time the Fed stepped back we were already at a peak. The damage had already been done. This is the problem with this bubble clause measure. The Fed is controlled by people and very few will have the political will and power to pop a bubble in the early making. What is there to gain? If Alan Greenspan popped the housing bubble in the early 2000s what would he have gained? Instead he kept inflating the bubble and allowed the mess to be cleaned up by his predecessor when the bubble inevitably burst causing the deepest recession since the Great Depression.

Yet we are now seeing the issues with keeping rates low for such a long-time. Inflation is now picking up in many sectors and is stripping the middle class of purchasing power. The Fed is actively targeting mortgage backed securities and is pretty much the only player in the mortgage market right now. Banks are operating in a private-public partnership where gains are privatized and losses are socialized. This bubble machine is perfectly setup. Even with housing and the middle class that rely on housing as the backbone of their financial wealth, families have lost over 5 million homes in foreclosure. Interestingly enough, many of these banks and hedge funds are buying up these properties from these bailed out banks. Those that were prudent are largely subsidizing all this activity.

----

A SAMPLING, "THE BEST OF (IMO)" COMMENTS FROM THE ZERO HEDGE CROWD:

from zerohedge.com

- Mr. Bernanke, what is the historical normal rate of interest in the United States?

- Mr. Bernanke, do you believe a low interest rate implemented for any significant period of time creates speculation, asset class bubbles, malinvestment, and other market disequilbriums? If no, why? If yes, could you please elaborate as to how this 'plays out?'

- Mr. Bernanke, do you believe that the low interest rate policy implement by The Federal Reserve since 2008 has caused or contributed to, in whole or part, speculation, asset class bubbles, malinvestment, and other market disequilbriums? If no, why? If yes, could you please elaborate as to how this manifested itself?

- Mr. Bernanke, is there any risk that the types of assets now held on the balance sheet of The Federal Reserve could fall in value in any significant way that would cause the Federal Reserve to either have to borrow money, raise more capital in another manner, require U.S. taxpayer assistance, or not be able to otherwise meet its financial obligations?

- Mr. Bernanke, you had previously told Congress that the Federal Reserve would "not monetize the federal deficit," yet The Federal Reserve has been and is still buying 50 billion worth of treasury notes per month, which constitutes 60% of all treasury note issuances. How is this "not monetizing at least 60% of U.S. government deficit spending?"

- Mr. Bernanke, you had said that The Federal Reserve was printing money back in 2009 in several interviews, including one on '60 Minutes.' However you now say that The Federal Reserve "is not printing money," and in fact, you said that in another '60 Minutes' interview this year. I have brought those two interviews with me and can play them for you and everyone here if you'd like to see them; it won't take more than a minute or so to watch the relevant parts of your statements then and now. How do you reconcile these two contradictory statements?

- Mr. Bernanke, you and other members of The Federal Reserve have stated that your policy of Quantitative Easing has contributed significantly to global inflation, including inflation in commodities, such as those related to energy and food. Many notable economists, such as Jim Grant and Laurence Kotlikoff, disagree with that assessment, and in fact, they claim there is data available which shows a direct and highly proportional relationship between Quantitative Easing and a rise in commodity, food and energy prices. Are you correct and are they wrong? If so, what data can you provide that supports your position?

- Mr. Bernanke, The Federal Reserve has supported policies that allow banks to essentially pay savers little to no interest, and interest that is far less than even The Federal Reserve's own official rate of inflation. Does this policy punish savers and the fiscally responsible American Savers, does it subsidize large financial institutions, including what many have deemed 'Too Big To Fail Banks,' and is this a healthy policy to maintain in lieu of America's large deficits and large national debt? As a follow up, shouldn't prudent monetary policy essentially do the opposite of this policy, by encouraging and rewarding savings, and discouraging and penalizing speculation?

- Mr. Bernanke, does or has the Federal Reserve ever directly or indirectly purchased equities, equity futures or options on equities - or any other intruments bearing on or related to equities? If so, which broker-dealer has the Federal Reserve used to purchase such equities, equity futures or equity-related instruments?

- Mr. Bernanke, has The Federal Reserve ever intervened in dealing between The Treasury Department and market participants, including but not limited to negotiations between The Treasury Department and AIG and its counter-parties, and has The Federal Reserve advised The Treasury Department as to what course of action to take with respect to the rate or amount of monies counter-parties to AIG or any other financial actor would or should receive via taxpayer-backed 'bailouts?'

- Mr. Bernanke, does The Federal Reserve have the intent to preserve the U.S. dollar as the world's reserve currency now and in the future? If yes, what measures are you taking and will you take to see this polocy objective achieved? If your answer is no, please elaborate on what the intent is?

- Mr. Bernanke, does The Federal Reserve have the intent to strengthen the U.S. dollar? If yes, what measures are you taking and will you take to see this polocy objective achieved? If your answer is no, please elaborate on what the intent is?

- Mr. Bernanke, should any financial institution or bank be allowed to get to a position where it alone or in conjuction with other entities represents a systemic threat to the U.S. or global financial system? Are there any such entities that exist today? If so, can you name them? If you can't name them, why can't you name them? If your answer is no, what did you do and what are you doing now to ensure that no such entities exist?

- Mr. Bernanke, did you ever smoke hash or drop acid & "trip" with Paul Krugman and talk about hostile extraterrestrial invasions of earth & how such events may shape monetary policy?

- Mr. Bernanke, is pathological lying more "nurture" or "nature?"

How do you sleep at nite? Can a person really not have a conscience?

You are going to turn into a rock and be blind, in the dark and in pain for eternity for what you have done and continue to do to humanity. Are you really ok with that?

When do you get off work tonite and where is your car parked?

Bernanke argues that the role of monetary policy in asset bubbles is not clear & we need to be open minded #fordsc #like a virgin at a gang rape

What about auditing the FED? 'Well, we've been around a long time and gotten away with it so far'.

...said it would be bad for Congress to be able to investigate his monetary policies.

Sorry Chairsatan, that's actually a very specific enumerated responsibility of the Congress in the Constitution. In other words, THAT'S THEIR JOB you megalomaniacal fuckface.

Sorry Chairsatan, that's actually a very specific enumerated responsibility of the Congress in the Constitution. In other words, THAT'S THEIR JOB you megalomaniacal fuckface.

"I read blogs." -Bernanke

He'll be straight on ZH when he get's online to see what we think of him. FUCKWIT.

blogs aww uhm, they, see, uhm, well, like news papers, they ahh uuhm, they printed what, see, ahh uhm, what, um, happened, so blawgs see, uhm, they, they, they, they, are an important, uhm, palce, see, for discource, uhm.. see, aaahh.. well,

you gotta love the quaver, it says "i know my power" and "holy fuck they know it's me who's "responsible"" all at the same time...

you gotta love the quaver, it says "i know my power" and "holy fuck they know it's me who's "responsible"" all at the same time...

Open Mouth Operations = Fellatio

---

This is a sampling of some of the tweets received, but not responded to by Ben Bernanke. This is what a pretty good sampling of what America thinks about him, The Fed and the course direction he is taking the economy and therefore, the nation.

I can't really feel sorry for him, he asked for it, he got it.

It seems as if he is held in about as high a regard as the Captain of The Titanic or the S.S. Minnow.

I can't really feel sorry for him, he asked for it, he got it.

It seems as if he is held in about as high a regard as the Captain of The Titanic or the S.S. Minnow.

lucasge RT @Not_Jim_Cramer: Dr. Bernanke, TMZ is reporting you have a stable of Unicorns for your own personal pleasure. Can you confirm or deny? #fordschoolbernanke -1:40 PM Jan 14th, 2013

mjoconn14 I heard you roomed with Lloyd Blankfein in college, did he have any quirky habits?! #fordschoolbernanke -1:48 PM Jan 14th, 2013

TheLimerickKing Did you commit pergury when you told congress you wouldn't monetize the debt...and are you still monetizing the debt? #fordschoolbernanke -1:59 PM Jan 14th, 2013

euromoney #fordschoolbernanke Have you ever been tempted to say "that's what she said" at the Fed presser? -1:59 PM Jan 14th, 2013

Claudia_Sahm RT @bkavoussi: @justinwolfers What are your plans after the Fed? Will you join Twitter or start a blog?#fordschoolbernanke -2:09 PM Jan 14th, 2013

sjysnyc Hypothetical: your dog dies unless you bring unemp<7 by eoy2013. (assume dog + love dog > hate infl) What do you do?#fordschoolbernanke -2:10 PM Jan 14th, 2013

Not_Jim_Cramer Ben, my 78 year old mom, who lives off T-Bills, is asking me "what happened?" What do I tell her?http://t.co/jmfkxEhn #fordschoolbernanke -2:14 PM Jan 14th, 2013

DomeBeers How have you avoided a jail term for so long?#fordschoolbernanke -2:22 PM Jan 14th, 2013

jruspini @justinwolfers I don't know what these manipulation and end-the-Fed type questioners hope to accomplish exactly here.#fordschoolbernanke -2:22 PM Jan 14th, 2013

zerohedge RT @GlobalMacroZen: What will be your exit strategy for the years to come to prevent inflation or do you think prayer helps? #fordschoolbernanke -2:32 PM Jan 14th, 2013

InEgo_ RT @PureGuesswork: What's your favorite color?#FordschoolBernanke <-- Green #Hoap -2:39 PM Jan 14th, 2013

moneymcbags Do you spell hyperinflation with one "oh shit" or two? #fordschoolbernanke -2:42 PM Jan 14th, 2013

jagouldmacro RT @GrantsPub: President Andrew Jackson killed the central bank of his time. What's his face doing on a Federal Reserve note? #fordschoolbernanke -2:46 PM Jan 14th, 2013

SeanJKerrigan RT @keepitrealdude: How far on the risk curve, do you want the investors to go? Should they be selling treasuries to buy Tulips? #fordschoolbernanke -2:49 PM Jan 14th, 2013

kptcfa RT @Nockian: Based on the tweets, this may be the first and last time Fed Chairman Ben Bernanke takes Twitter questions#fordschoolbernanke -2:49 PM Jan 14th, 2013

MaggieL RT @__redpill__: Have you ever engaged in group mockery of Timothy Geithner? #fordschoolbernanke -2:51 PM Jan 14th, 2013

bradleypoo #fordschoolbernanke At what point would you finally admit the Federal Reserve has failed? -2:52 PM Jan 14th, 2013

JEliasof RT @azizonomics: Does the Bank of England's research showing that QE has enriched the top 5% much more than everyone else worry you? #fordschoolbernanke -2:52 PM Jan 14th, 2013

MacGhil RT @__redpill__: Do we really need taxes if you can just create the money we need? #fordschoolbernanke -2:54 PM Jan 14th, 2013

Wu_Tang_Finance #fordschoolbernanke WHAT THE FUCK U DO TO YOUR BEARD EVERYDAY DAM THAT SHIT LOOKS FLY AS FUCK -2:59 PM Jan 14th, 2013

peakcheezburger RT @azizonomics: #fordschoolbernanke Mr Chairman, Japan recently started a 10th round of QE, still stuck at ZB. Is the USA in danger of a similar depression? -3:07 PM Jan 14th, 2013

ejmoosa #fordschoolbernanke When's the last time you bought groceries and saw a price drop? -2:52 PM Jan 14th, 2013

WinningUgly12 #fordschoolbernanke Does it bother you that all savers, particularly seniors, are being crushed as you print money for criminal banksters? -3:08 PM Jan 14th, 2013

No comments:

Post a Comment